A SaaS financial model is a unique instrument. While simple on the surface, diving into the underlying assumptions reveals a complex set of intertwined data all working together to drive bottom line revenue and growth.

You’re probably thinking “Yea, whatever – it’s revenue minus expenses just like every other business”.

But it’s actually much more than a “price times quantity equals dollars in my pocket” sort of thing.

The average business is pretty easy to understand, right?

They sell some sort of good or service for a price, a transaction is made, and they record it as revenue. The more they sell, the more money they make. Easy enough.

SaaS businesses are different. There are different inputs driving revenue and growth in a totally different way than your traditional retail business. Revenue is earned over time on a recurring basis, so retaining your customers is that much more important.

And seeing that a SaaS business is so much more different, let’s take a look at some of the key pieces that make a SaaS financial model different as well.

Recurring Revenue

Recurring Revenue is the lifeblood of a SaaS company.

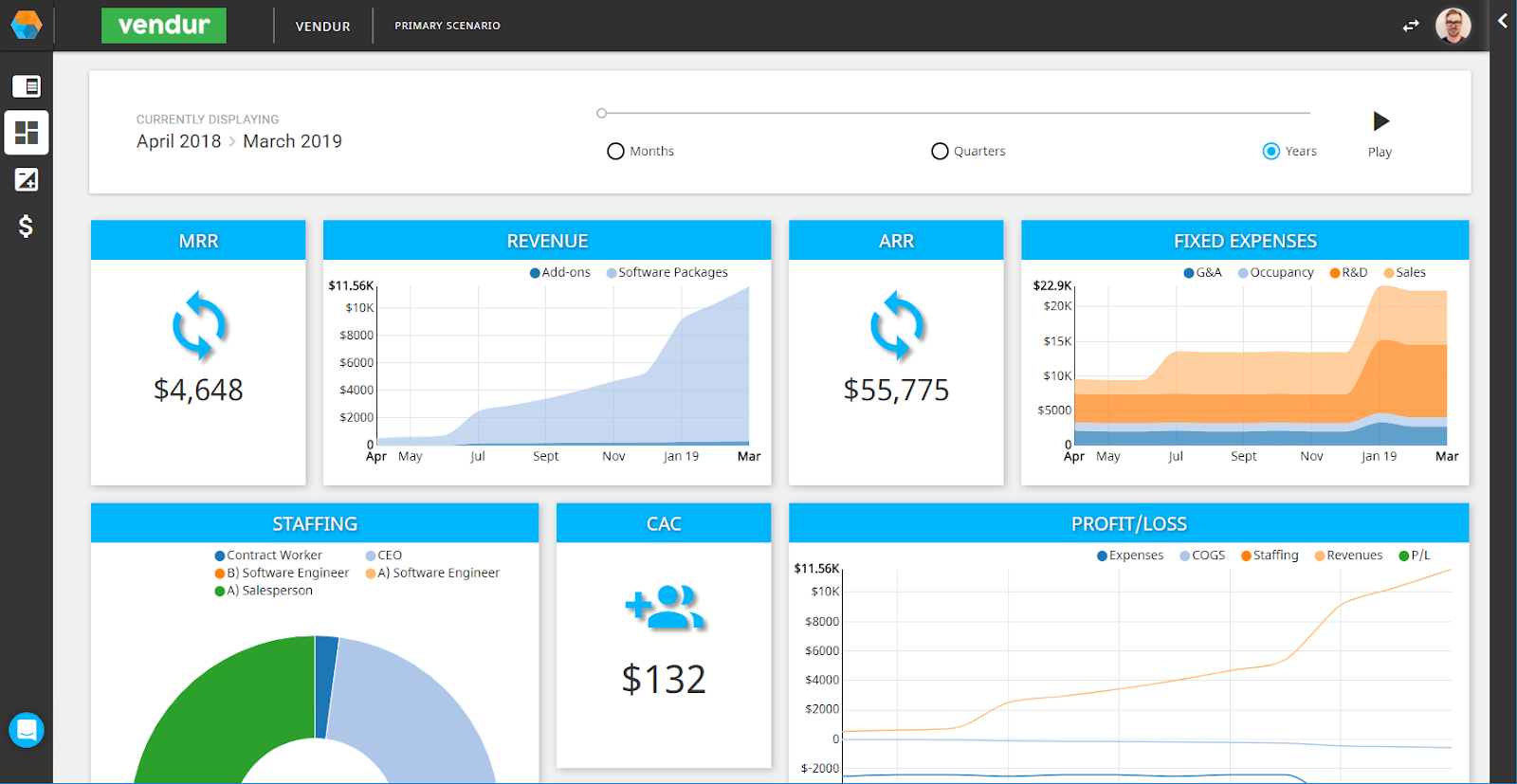

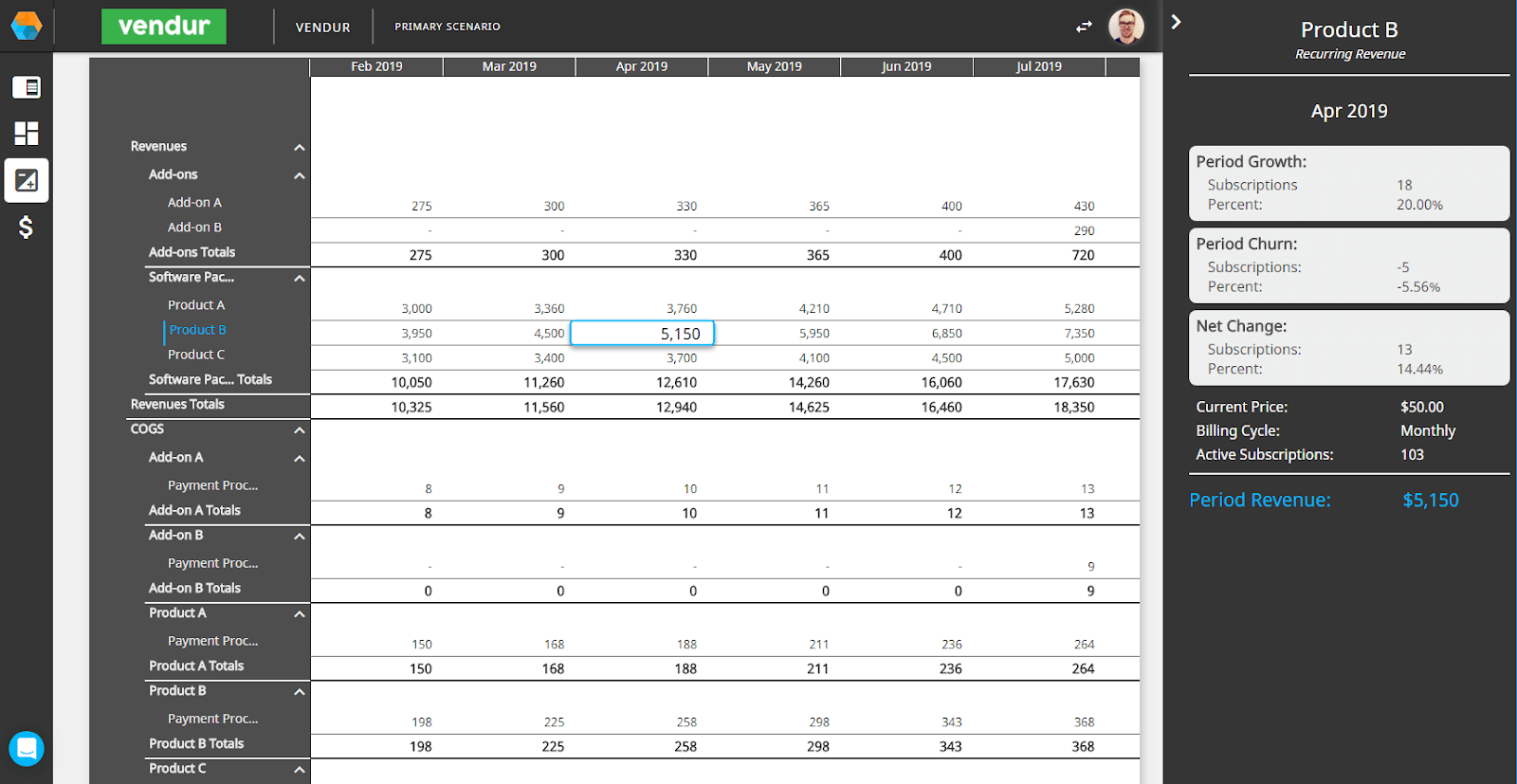

Recurring revenue is a fairly straightforward concept – it’s the sum of all your recurring revenue streams over a particular time period. It’s typically calculated in terms of Monthly Recurring Revenue and Annually Recurring Revenue, or MRR and ARR, respectively.

When thinking about Recurring Revenue in terms of your SaaS financial model, they key driver of your MRR is determined by how quickly you are able to grow that MRR on a month-to-month basis, also known as your MRR Growth Rate.

MRR growth varies heavily depending on the stage of your company, industry, lifetime value, and a variety of other important factors.

For example, a brand new, just-released product line is going to have an entirely different set of growth rates than a SaaS product that has been out for a few years.

And what’s more, is growth rates are always changing – you can’t expect to be growing at MRR by 40% forever (even though that does sound really nice)!

The key is to do your research and use any historical data you might have to know exactly what a realistic growth rate is for your business both right now and going forward.

You can check out a cool example of a SaaS financial model with recurring revenue streams here! (password: “vendurinvestors2018”)

The other (not-so-fun) side to Recurring Revenue, is your company’s Churn.

Churn

Churn is a part of your recurring revenue, but its importance deserves its own separate section in this post.

While recurring revenue drives money flowing into the company, a company’s ability to reduce churn is what keeps that money on flowin’.

On a fundamental level, churn is equal to the customers or revenue you lost over a certain time frame, and is typically expressed as a percentage in terms of either Customer Churn or Revenue Churn.

Customer churn is calculated by simply taking the number of customers lost for the period and dividing by the total number of customers.

Predicting Churn rates in your SaaS financial model can get a little tricky at times.

Similar to MRR growth, determining acceptable churn for your forecast depends on many factors specific to your business.

For example, if you just released a new product, you might experience low churn at first while your customers mainly consist of power users (aka your loyal fans).

However, chances are a new product has a few issues that need to be taken care of. And that once flawless churn will probably rise pretty damn rapidly month over month as you on-board more users. But don’t worry – as you develop, iterate, and fix bugs, that churn slowly starts to reside to a normal and sustainable level.

So you’ve got your MRR and Churn, but how do you measure if they are plausible assumptions in your financial model?

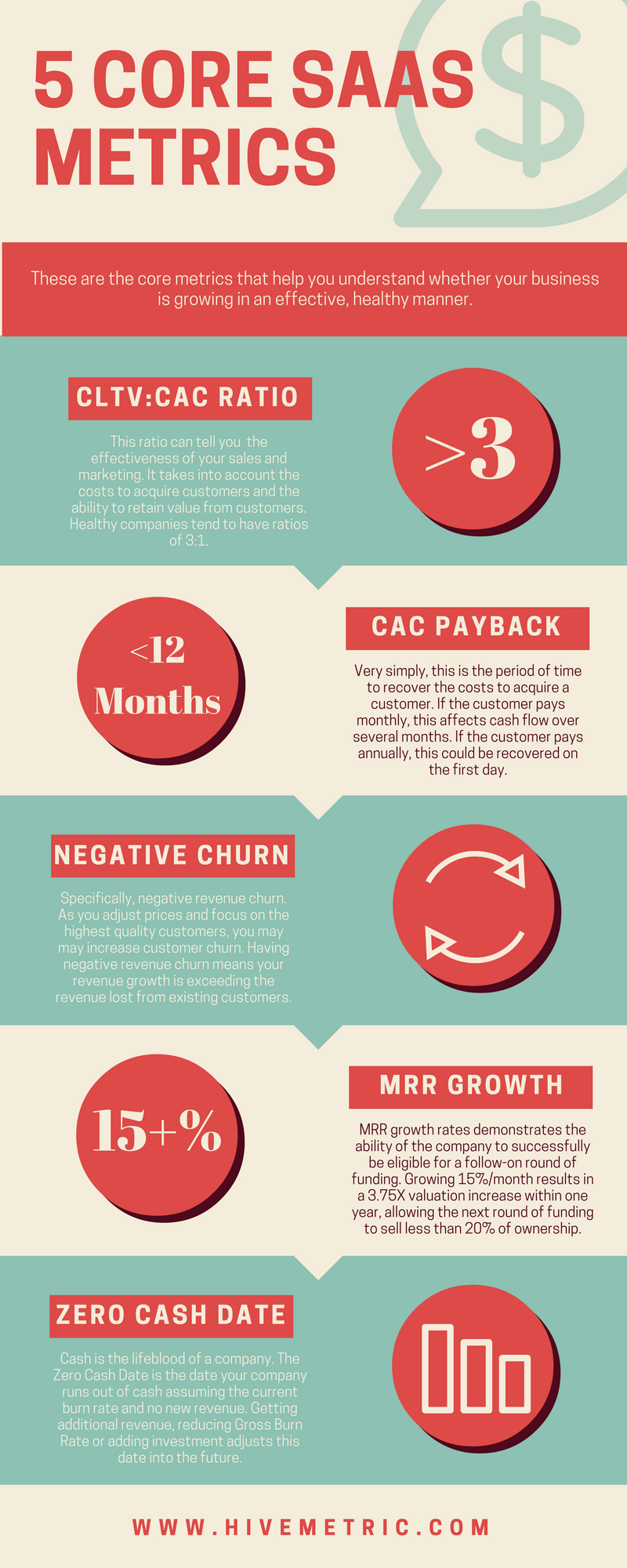

Metrics: CAC & LTV

There are a variety of metrics to be tracking as a SaaS company – different metrics than one might gauge in a traditional business. And similar to how Recurring Revenue and Churn are essentially the backbone of your business, your key metrics revolve around some of the same variables.

Arguably two of the most important metrics are Customer Acquisition Cost and Lifetime Value, or CAC and LTV.

They are relatively simple to calculate, but their impact is absolutely essential in monitoring the effectiveness of how you are generating revenues and allocating spending.

Your Customer Acquisition Cost (CAC) is how much money you have to spend to acquire one additional customer. It is calculated by taking your total spend on Sales & Marketing, and dividing by the number of new customers you brought in for a specific period.

Your Lifetime Value (LTV) is how much revenue, on average, a customer will give you in total while they are a paying user of your SaaS product.

While you might be thinking, “Ok, so decrease CAC and increase LTV”, it’s much easier said than done.

When it comes to financial modeling, the key is to be carefully watching your LTV:CAC ratio. An LTV:CAC greater than 1 says that you can expect to be earning more revenue over a customer’s lifetime than you had to spend to acquire that user.

The general rule of thumb as a SaaS business is to aim for this ratio to be greater than 3. However like many other metrics, this will vary depending on the stage of your company.

For example, when you’re starting out, as expected your LTV:CAC will likely be much lower than if you are a thriving SaaS powerhouse, since you’ll have to spend a lot more to acquire your first users – so be sure to keep this in mind when forecasting your business.

And if you’re looking to dive deep into SaaS metrics, David Skok’s SaaS Metrics Guide is the best there is out there right now!

Getting Started on Your SaaS Financial Model

I hope this helped to give a basic understanding of how some of the key pieces in a SaaS financial model function and interact with one another, and how you can use them to create a more informed, educated, and valid financial forecast for your company.

For more on financial modeling, startup life, and other SaaS metrics, be sure to check out our Resources and Hivecademy.

And if you happen to be looking to create a SaaS financial model, but you’re sick of navigating through the sea of Excel templates out there, you should know that you’re not alone.

Hivemetric has helped hundreds of SaaS startups just like yourself develop and automate their financial forecast, without ever having to touch an excel spreadsheet. It’s completely free to sign up, and we’re always excited to be learning about new SaaS businesses!!!